The stock market is a highly profitable industry, Is essential be subject to taxation?

The Benefits of a Financial Transaction Tax. I discuss the benefits of a financial transaction tax, including its ability to reduce the profitability of speculative trading on stock exchanges. This tax ensures an increase in the tax rate on these...

The Benefits of a Financial Transaction Tax

I discuss the benefits of a financial transaction tax, including its ability to reduce the profitability of speculative trading on stock exchanges. This tax ensures an increase in the tax rate on these profits, while not affecting regular investment transactions....

Proposed EU Financial Transaction Tax Faces Debate

I discuss the proposed financial transaction tax at the EU level, where all goods and services are subject to taxation, so the rationale is to also tax financial transactions. The European Commission has proposed limiting the tax to transactions between...

The Impact of Speculation on the Economy

I discuss the rise of speculation and its significant impact on the economy. Many businesses are now focusing on making quick profits through investments rather than producing goods or providing services. This has led to market volatility and an environment...

The Dominance of Speculation over Production in Financial Institutions

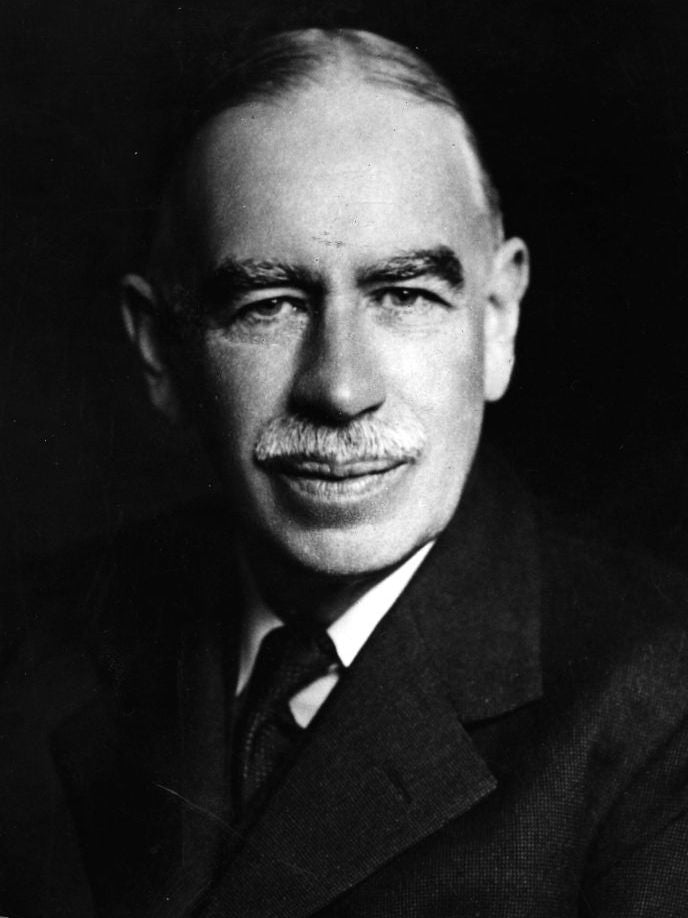

I discuss how speculation can dominate production activity as investment markets expand, as warned by economist John Maynard Keynes. This situation has become more precarious as traditional business activities are given less importance compared to speculative ones, which is exactly...

Tubing Tax: Promoting Long-Term Investments and Stable Markets

i discuss the purpose of the tubing tax, which is to redirect speculators towards long-term investments by making it more attractive for them to switch their assets towards productive investments. This can be achieved by making the process of switching...